CEPRES FOR LIMITED PARTNERS

CEPRES empowers LPs to make better investment decisions through enhanced data and analytics solutions

Accelerate your investment impact

Accelerate your investment impact

CEPRES helps consultants support their recommendations and analysis with comprehensive and current industry data. CEPRES offers unique solutions to efficiently screen, research and monitor private capital markets to successfully execute and prepare clients’ investment policies or commercial due diligence projects.

Find out how our products will benefit you

CEPRES empowers LPs throughout the investment lifecycle

Scenario plan

Use CEPRES’s proprietary, bottoms-up multi-factor predictive models to forecast cash flows, NAV, IRR and MOIC for your clients. Manage, simulate and report on complex liquidity terms, calculations and scenarios. Analyze current investments and monitor asset allocation.

Streamline portfolio monitoring

Evaluate, monitor and optimize your clients' portfolios to meet their investment goals. Track and report on complex liquidity terms, calculations and scenarios. Measure systematic private market risks and benchmark against investment goals.

Accelerate due diligence

Leverage a customizable and complete track record analysis with fund and deal market benchmarking. Complement your industry expertise with accurate fund and company benchmarks to further prove your recommendations.

Optimize financial strategies

Test future allocation models and commitment plans to see how they impact NAV, performance and liquidity over quarters, years and decades. Receive probability distributions influenced by macro factors, including interest rates, F/X, terms of trade, among others. Generate variable outcomes to assess ALM impact.

CEPRES powers better private market investments

Increasing headwinds put portfolios and commitments at risk. Without the right data and solutions, you can leave millions on the table and add unnecessary risk. CEPRES offers clients the best private market data access and coverage.

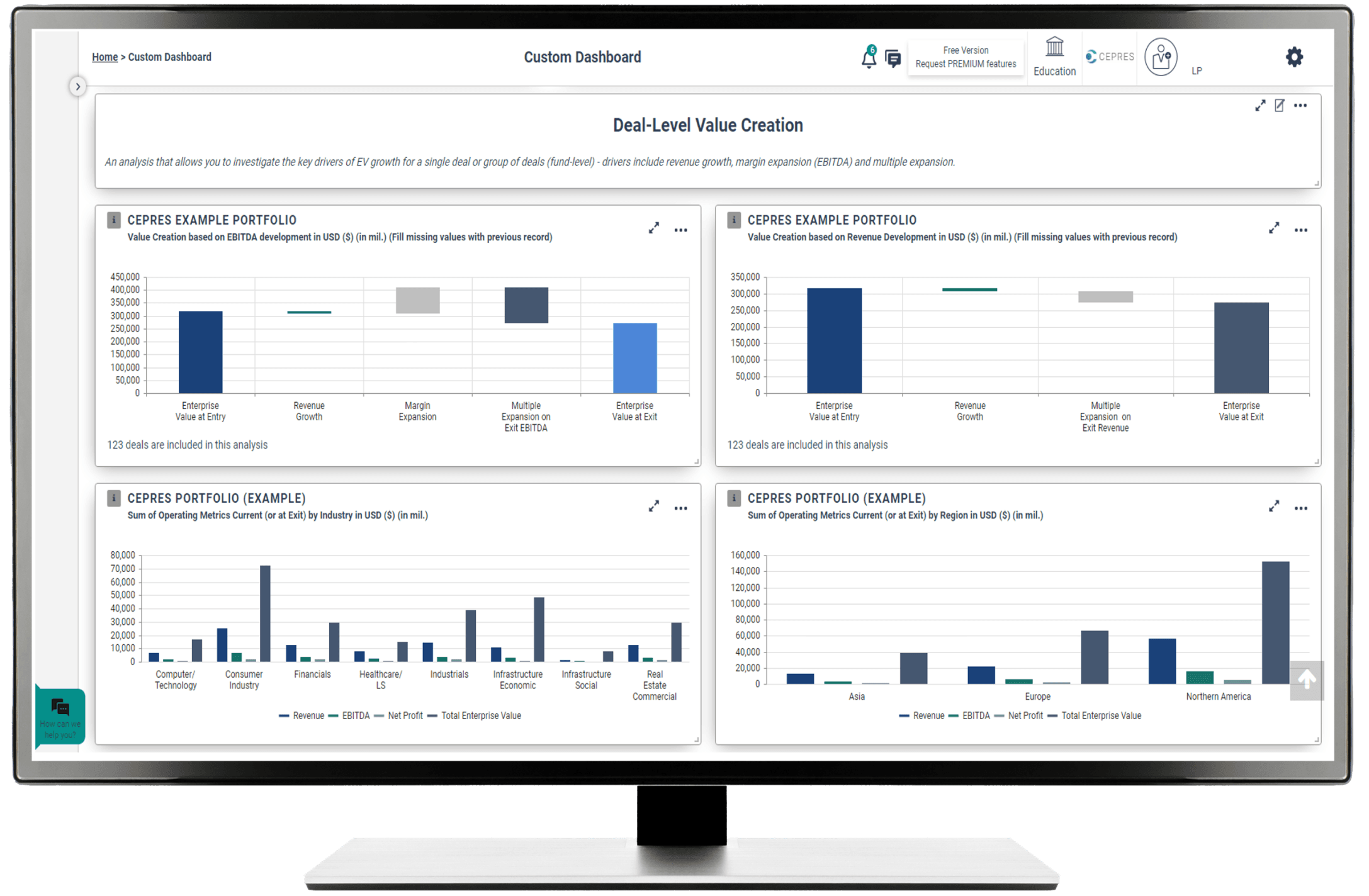

Through CEPRES's secure GP data network, you can get detailed investment records directly from fund managers with complete cash flows of funds, deals and portfolio company operating metrics. Look through fund-level metrics into underlying assets to make better investment decisions throughout the investment lifecycle.

CEPRES provides the most accurate, actionable private market data

FAQs

Measure your investments versus private and public markets to meet your targets. Exclusive to CEPRES, you can benchmark against fund-level data and the world's most extensive collection of private deal-level market data and operational comps.

CASE STUDY

Helping a leading insurer slash due diligence time by 25%

A large insurer spent significant time engaged in GP screening and track record due diligence. Through CEPRES, the GP provided the LP with the detailed fund, deal and operating company analysis and the ability to benchmark against 100k+ deals.

The insurer immediately realized 25% time savings by replacing manual analysis with an automated systematic one. It also gained a complete audit trail for all investment decisions to present to the investment committee. After commitments were made, the same data access process was maintained for the constant portfolio monitoring and risk management at the same granular analysis level as the due diligence was conducted.

OUR LATEST CONTENT

Thought Leadership

15.12.2024 /

REPORT

CEPRES 2025 Private Credit Outlook

As we move into 2025 with a 50 basis point rate cut already implemented, private credit faces a mixed yet promising outlook. Private credit is directly impacted by these rate changes.

Read full article22.10.2024 /

ARTICLE

Introducing the DealEdge Free Trial: Unlock Market Insights with CEPRES Data

We’re excited to introduce the DealEdge Free Trial, powered by CEPRES' exclusive data. With the launch of this free trial, we’re also proud to announce that DealEdge has crossed the threshold to over 50,000 deals, covering 570+ subsectors and 200+ countries from 1970 to 2024.

Read full article22.10.2024 /

ARTICLE

How will the decline in interest rates affect the private capital markets?

The twenty-first century has experienced a range of different interest rate regimes - from the aperiodic near-zero interest rate environment of most of the 2010s to the fluctuations seen in the early 2000s, and now again (more sharply) in the 2020s.

Read full article07.10.2024 /

ARTICLE

Forecasting Private Equity Fundraising

Fundraising forecasting, like portfolio forecasting, offers an intriguing opportunity, especially with recent advances in technologies like AI, for funds to develop more confident workflows, drive down costs, and lift overall fund performance.

Read full article