PORTFOLIO MANAGEMENT

Due Diligence

Fast and customizable GP track record analysis with fund, deal, and operating-level benchmarking to enhance underwriting decisions.

Fast and customizable GP track record analysis with fund, deal, and operating-level benchmarking to enhance underwriting decisions.

Streamline and enhance private market underwriting decisions with greater precision.

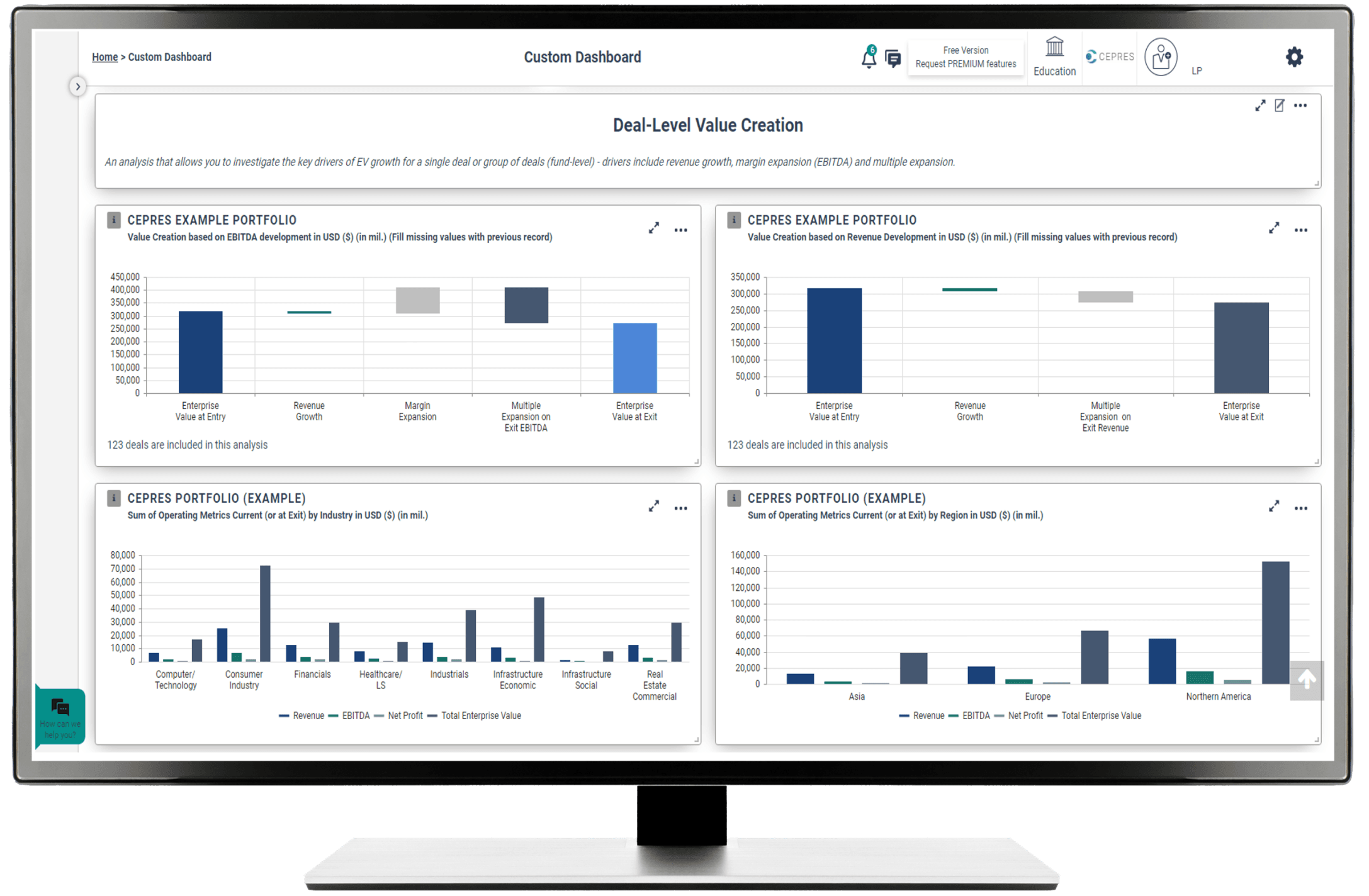

CEPRES Due Diligence enables granular and accurate 'look-through' data on GP track records so LPs know how GPs create value and handle risk across different market cycles. By automating and enabling deeper track record analytics, investors don’t need to waste time manipulating data in Excel, but can focus on choosing the best GPs to secure their returns.

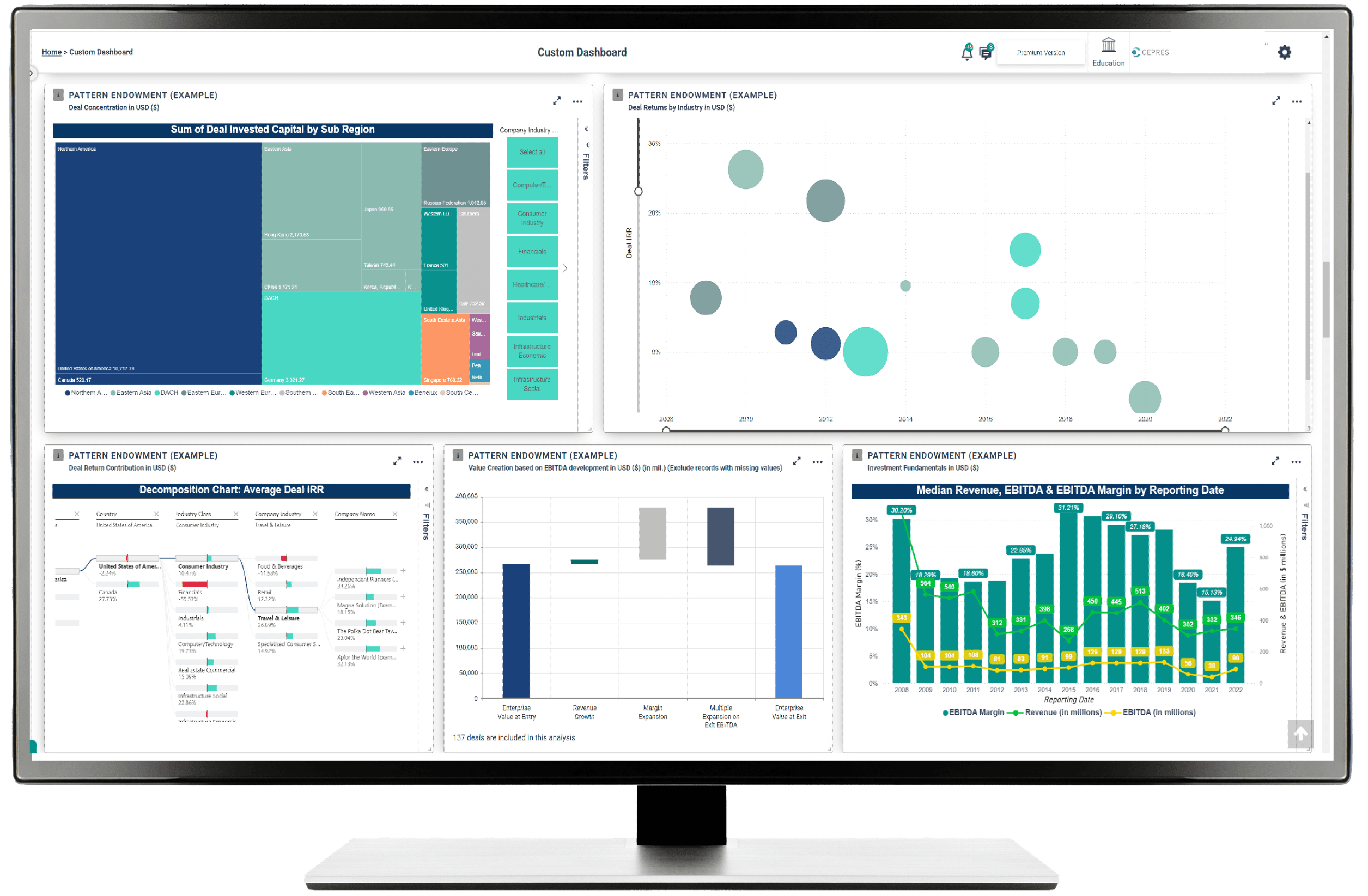

With numerous analyses like sector exposure, fund and deal leverage, value creation, EBITDA growth, and much more, you can better evaluate every GP.

Additionally, CEPRES unique fund, deal and operating metric benchmarks across 13,000 funds and 130,000 deals gives you confidence in how GPs stack up against their peers so you aren’t investing blind.

Features

Automated data collection and standardization, removing the requirement to manipulate data in Excel.

Excel Add-In that allows users to upload GP track records into preloaded templates and instantly connect the data to CEPRES to get their analysis up and running in minutes.

Fully encrypted and confidential data rooms allow GPs and LPs to securely share private market data.

Unmatched granular analytics backed by portfolio company operating cash flows.

Analysis capabilities to compare fund strategy, allocation, performance, and risk. Generate fund, deal and operating company analysis, including IRR, TVPI, EBITDA multiples, value creation, and hundreds more.

Connect to GPs in your network and request secure access to their Track Records. Join the CEPRES confidential community to benchmark against 13,000 funds and 130,000 deals for better investment decisions.

Portfolio Management Solutions

Analysis Builder

Fully integrated Power BI with comprehensive data model enables unlimited analysis customization with no IT effort.

Fund Screener

Pipeline management and powerful GP track record analysis.

Predictive Intelligence

AI-based portfolio simulation and tracking software utilizing multi-factor and Monte Carlo simulations to forecast portfolio outcomes and improve ALM and asset allocation planning.

Portfolio Monitoring

Portfolio look through, performance analytics, benchmarking, and risk analysis enriched by the industry’s best private market data set.

FEATURED CONTENT

The PE industry has grown rapidly over the last two decades, recording an extraordinary increase in funds raised, fund size, deal volume, and overall deal size. But a perennial challenge – illiquidity – has remained largely unresolved, until now.

The Solactive CEPRES US Private Equity Industry Replicator Index is a new approach that provides return exposure to the return profile of buyout funds focused on North America.

This new replication approach, based on reweighting publicly listed equities, can deliver a similar performance to the North American private equity sector.

OUR LATEST CONTENT

Thought Leadership

15.12.2024 /

REPORT

CEPRES 2025 Private Credit Outlook

As we move into 2025 with a 50 basis point rate cut already implemented, private credit faces a mixed yet promising outlook. Private credit is directly impacted by these rate changes.

Read full article26.11.2024 /

ARTICLE

The PE Data Collection Landscape: How GPs Are Meeting Modern Transparency Requirements

The broader private equity landscape has experienced remarkable change over the past decade across several areas – from portfolio management best practices to leveraging AI and modern data platforms within portfolios at scale – and top performing funds have been able to successfully adapt their investment approach to what the market and LPs expect.

Read full article22.10.2024 /

ARTICLE

Introducing the DealEdge Free Trial: Unlock Market Insights with CEPRES Data

We’re excited to introduce the DealEdge Free Trial, powered by CEPRES' exclusive data. With the launch of this free trial, we’re also proud to announce that DealEdge has crossed the threshold to over 50,000 deals, covering 570+ subsectors and 200+ countries from 1970 to 2024.

Read full article22.10.2024 /

ARTICLE

How will the decline in interest rates affect the private capital markets?

The twenty-first century has experienced a range of different interest rate regimes - from the aperiodic near-zero interest rate environment of most of the 2010s to the fluctuations seen in the early 2000s, and now again (more sharply) in the 2020s.

Read full article