CEPRES DATA ADVANTAGE

Gold standard investment grade data straight from the source

Get granular, actionable data and insights from the world’s largest private market investment data network

Unlock data-driven insights for better investment decisions

At CEPRES, our data advantage comes from direct sourcing from private equity fund managers, including 93% of the PEI 100. We access detailed data directly from GPs' warehouses, down to the portfolio company P&L level, ensuring accuracy and depth. This allows investors to look beyond high-level metrics into cash flows, strategy, and returns. CEPRES clients can explore key performance indicators like CAGR and EBITDA, gaining a deeper understanding of fund performance.

Our best-in-class data governance ensures every data point is verified, enabling precise, actionable insights and true apples-to-apples comparisons. This rigorous process allows for 100% accuracy, giving our clients the confidence to make true apples-to-apples comparisons and actionable investment decisions.

Because if you don't have CEPRES, you don't know.

Unmatched Data Sourcing

CEPRES Data Network

For over 20 years, CEPRES has served the world’s most influential private market investors. Today, we are the largest provider of verified private market intelligence and facilitate data exchange between thousands of LPs, GPs and more.

Our data network solves the capture, distribution and consumption of private market investment data as the basis for collaborative investment decision-making processes.

We ensure data is verified and reconciled to the highest level before consumption, using robust ETL processes, backed by expert investment analysts. Data is also sourced from and reconciled against quarterly statements to attain the highest accuracy and granularity. Throughout the process, any gaps, discrepancies or inconsistencies are checked before the GP shares internally or with chosen investors

Unique Data Processes

Superior Data Quality

CEPRES data processing is comprised of harmonized procedures, resulting in quality standards above and beyond other data suppliers. Our managed SaaS data network collects primary sourced data from GPs, while a precise legal framework and trusted Mediation Team to ensure SLAs are met. Our strict data processing automation and verification procedures ensure the highest level of data accuracy.

Unrivaled Data Security

Best in class governance and security.

CEPRES has developed the most secure platform and policies to protect your data and ensure you maintain control over who has access and how.

Data is protected by industry-leading security standards. In over two decades of processing investment data on more than 13,000 funds and more than 100,000 PE-backed deals, we have never had a security or confidentiality breach. All named data is protected with 256-bit military-grade encryption, making it uncompromisable.

Read our Data FAQs to find out why the CEPRES’ Data Ecosystem, our data sourcing capabilities, and our data security measures are peerless.

What Makes Us Different

Data sourced directly from private equity fund managers, including 93% of the PEI 100.

Our legal framework allows us to source data directly from GPs’ data warehouses or data lakes, down to the portfolio company P&L level.

Look-through to portfolio company performance.

Deep, granular data, enabling you to look through high-level fund performance metrics into the underlying cash flows of a fund’s portfolio companies.

Unmatched portfolio company performance.

Explore operating company performance — CAGR, revenue growth, margin, EBITDA and thousands more.

Best-in-class data governance.

We verify and reconcile every single data point at the highest level — ensuring 100% of the data you utilize is accurate, governed and actionable.

CEPRES Data Solutions

Look-through Data

Look-through data is the gold standard for private market data. Based on the underlying cash flows and operating metrics of a fund’s portfolio companies and assets, look-through data can help evaluate asset-level capital-weighted returns, delivering insights into the true value and performance drivers of investments.

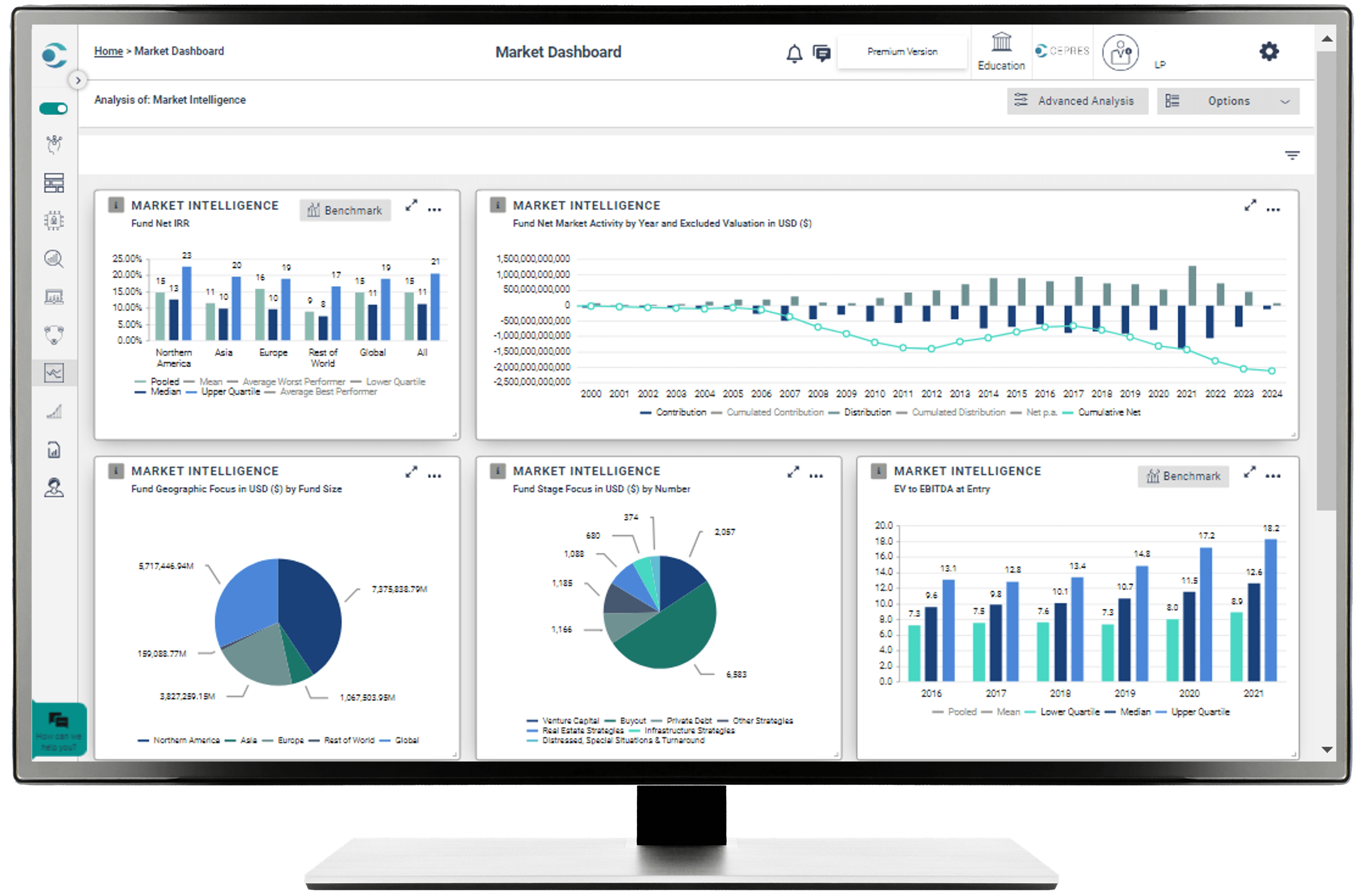

Market Intelligence

In the age of private equity digital transformation, data is the new currency. Backed by operating company cash flow data from thousands of the world’s top GPs and LPs, CEPRES Market Intelligence helps private market investors maximize returns, reduce risk and uncover hidden potential. All while gaining a true outside-in perspective.

Managed Data Network

CEPRES is the largest provider of verified private market intelligence and has facilitated data exchange between thousands of LPs, GPs and more. Our data network solves the capture, distribution and consumption of private market investment data as the basis for collaborative investment decision-making processes.

Market Research

CEPRES Market Research provides investors with comprehensive fund, deal, and asset level analyses to make and test market theses and underwrite investment strategies. Model and forecast risk, returns, cash flows and NAV for portfolio optimization, and get an outside-in vantage point to optimize asset allocation, reduce beta, and maximize returns.

CEPRES works directly with GPs to source the data you need to meet your portfolio goals. We verify every data point, down to individual operating cash flows, ensuring that 100% of your data is accurate, actionable and governed.

With more than 13,000 funds and 1,000,000 cash flows, CEPRES provides the most accurate, actionable private market data.

Leverage 50+ years of portfolio company cash flow performance as empirical evidence to make more informed investment decisions.

CEPRES Data Partnerships

Through our partnerships with some of the world’s most influential companies in the private capital markets, CEPRES provides clients with actionable data and analytics to help them make better investment decisions.

Replicator Index

The Solactive CEPRES US Private Equity Industry Replicator Index utilizes CEPRES data to provide exposure to buyout funds with North American focus replicating their performances with publicly listed securities from the United States 500 universe.

DealEdge

Jointly built by Bain & Company and CEPRES, DealEdge is a powerful, intuitive digital advisory product that gives private equity investors unprecedented insight into which deals have the most potential and where hidden opportunities exist to create value.

API integration

CEPRES partners with LeadingMile to utilize their cutting edge API integration to provide CEPRES data users with data accuracy and precision across third-party systems.

Featured Content

The PE industry has grown rapidly over the last two decades, recording an extraordinary increase in funds raised, fund size, deal volume, and overall deal size. But a perennial challenge – illiquidity – has remained largely unresolved, until now.

The Solactive CEPRES US Private Equity Industry Replicator Index is a new approach that provides return exposure to the return profile of buyout funds focused on North America.

This new replication approach, based on reweighting publicly listed equities, can deliver a similar performance to the North American private equity sector.

Insights

The Maturing Market: How Secondaries Are Redefining Liquidity, Pricing, and Portfolio Strategy in Private Equity

Learn how advanced secondary modeling can help you manage liquidity, pricing, and portfolio risk in today’s private equity market.

Navigating Private Markets in a Changing Landscape: Data Driven Insights to Optimize Returns and Manage Risk

Private equity has entered a new phase — returns are converging, risks are rising, and data-driven decision making now defines success.

Drawing on 20 years of CEPRES deal-level data from over 140,000 deals, this whitepaper reveals how top-quartile managers continue to outperform in today’s volatile market.

Learn how leading allocators are using data transparency to capture the next generation of returns.

Download the whitepaper

CEPRES' 2026 Private Equity Buyout Outlook

With fundraising still below pre-peak levels and market conditions evolving, LPs and GPs face mounting pressure to deliver returns. Download our latest report for data-driven insights into how top firms are refining strategies, structuring deals, and driving performance to stay competitive through 2026.

The Maturing Market: How Secondaries Are Redefining Liquidity, Pricing, and Portfolio Strategy in Private Equity

Learn how advanced secondary modeling can help you manage liquidity, pricing, and portfolio risk in today’s private equity market.

Navigating Private Markets in a Changing Landscape: Data Driven Insights to Optimize Returns and Manage Risk

Private equity has entered a new phase — returns are converging, risks are rising, and data-driven decision making now defines success.

Drawing on 20 years of CEPRES deal-level data from over 140,000 deals, this whitepaper reveals how top-quartile managers continue to outperform in today’s volatile market.

Learn how leading allocators are using data transparency to capture the next generation of returns.

Download the whitepaper

CEPRES' 2026 Private Equity Buyout Outlook

With fundraising still below pre-peak levels and market conditions evolving, LPs and GPs face mounting pressure to deliver returns. Download our latest report for data-driven insights into how top firms are refining strategies, structuring deals, and driving performance to stay competitive through 2026.