New York, USA – March 4, 2021 — The latest CEPRES Private Capital Market Outlook highlights the impacts of COVID-19 and offers an economic review of 2020, an analysis of the last quarter of the year, and insights for 2021.

The 4% GDP expansion in Q4 was driven by increases in consumer spending, exports, nonresidential fixed investment, residential investment, and inventories. However, GDP expansion was still weighed down by declines in government spending at the federal, state, and local levels. Specifically, consumer spending increased by 2.5%, exports rose by 22% and gross private domestic investment surged by 25.3% while government spending contracted by 1.2% that was primarily due to an 8.4% decline in non-defense spending.

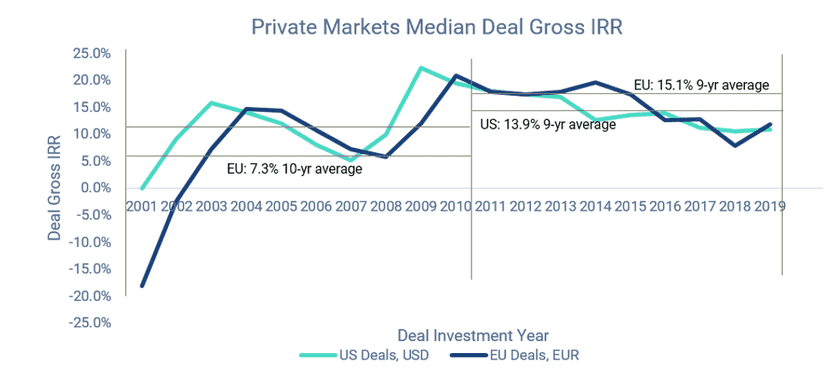

US buyout investment volume rose by almost 40% QoQ and YoY, making Q4 2020 one of the strongest quarters in terms of equity value invested in buyout transactions. In terms of venture capital, US investment volume during the last quarter of 2020 declined by 10% QoQ but remained ahead of the same quarter in 2019 by almost 20%. Despite any setbacks in investment activity resulting from Covid-19 lockdowns and economic recessions, the overall growth of the private markets asset class over the past two decades is clear, as an analysis of Median Deal Gross IRR demonstrates. As the asset class matures, it should be expected to continue to grow over the next 10 years.

Source: CEPRES Platform

Copyright © 2021 CEPRES GmbH

The full report is available to CEPRES subscribers:

All analysis is generated from investment and portfolio due diligence conducted on the CEPRES Platform by investment counterparties, based on actual transactions. More information and further detailed analysis is available to CEPRES clients and upon request.

Commentary:

“Moving into Q1, investors should be aware that political and public health conditions will have a direct impact on Private Markets. In the US, transportation assets, social infrastructure assets, and clean technologies are a common theme across strategies, due in part to federal promises to invest in infrastructure and renewable energy. However, any increases in spending will be largely dependent on the wide-spread availability of vaccines.”

Dr. Daniel Schmidt, Founder & CEO, CEPRES.