New York, USA – March 30 2021—The latest CEPRES report on Infrastructure closely examines both the evolution of infrastructure strategies in private markets and historical returns across economic cycles and during periods of market disruption, providing in-depth analysis vital for anyone interested in making North American or European infrastructure part of their portfolio.

The analyses presented in the article are based on CEPRES Market Intelligence, comprised of primary sourced and verified infrastructure data from CERPES’ global private investment network, consisting of net and gross cash flows, and the underlying operating data of the assets. Also included is an examination of Brownfield vs. Rehabilitated Brownfield vs. Greenfield infrastructure project stages and a meditation on the steady growth of the private infrastructure investment asset class over the past 20 years.

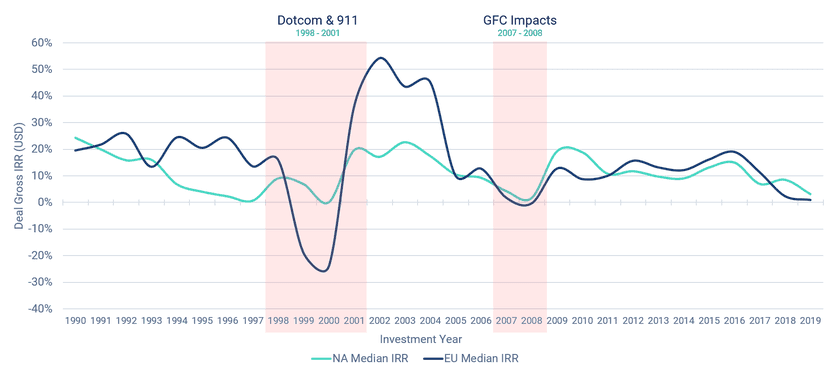

Some findings of note include the fact that, during the immediate aftermath of market shocks, many investors tend to be more prudent and hesitate to invest; however, it is during these short periods that many see superior returns. The author provides by way of example the years 2001 and 2009, when median returns in both Europe and North America rapidly increased to new peaks, after bottoming just a year before.

After comparing median gross IRR returns by region, CEPRES researchers also found that while infrastructure in Europe generally outperforms North America across most non-crisis years, the wide outperformance spread in the 1990s and early 2000s narrowed significantly in the past decade between 2011 and 2019. Returns in Europe during the ‘90s and early ‘00s also displayed much higher volatility compared to North America, so while European returns have historically been higher, the corresponding risks have also been higher. Finally, the research also indicates that median gross IRR returns since 2010 have both moderated and stabilized, suggesting that the infrastructure market has matured and seen a steady increase over the last ten years.

Source: CEPRES Platform

Copyright © 2021 CEPRES GmbH

Findings in CEPRES’ new infrastructure report are consistent with, and supported by, the insights provided in another recent publication, CEPRES’ Q4 Private Markets Report, which is available online for further reference. By and large, the findings of this paper indicate that in order to make making attractive risk-adjusted returns in infrastructure requires professionals to base investment decisions on trusted market intelligence founded on empirical, primary-sourced data and insightful analytics.

The full report is available to CEPRES subscribers

All analysis is generated from investment and portfolio due diligence conducted on the CEPRES Platform by investment counterparties, based on actual transactions. More information and further detailed analysis is available to CEPRES clients and upon request.