MARKET DATA

Market Intelligence

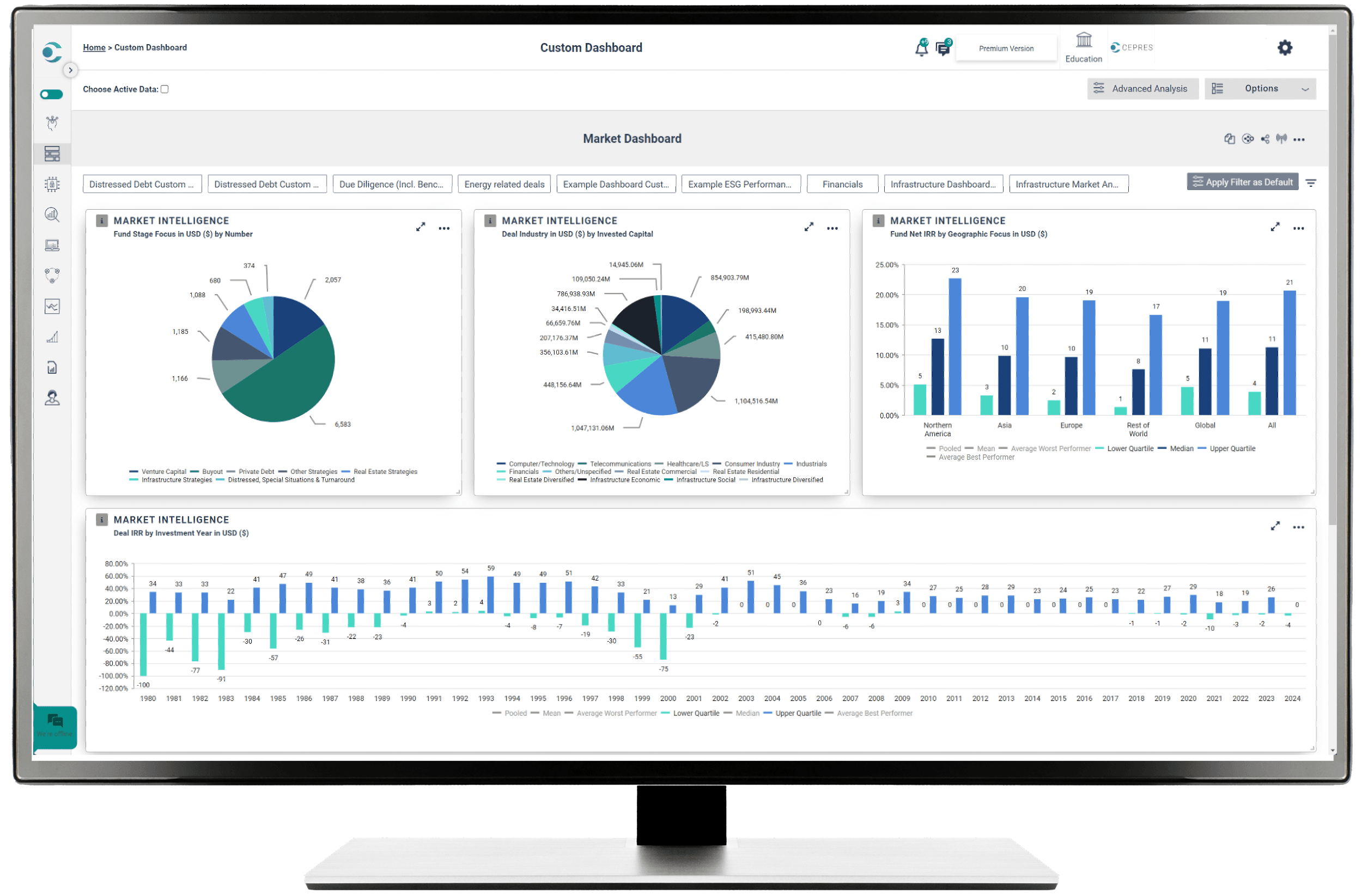

Empowers investors with unparalleled accuracy and transparency into private market data and insights.

Your Single Source of Truth in Private Market Investing

Unlock the full potential of your investment strategy with CEPRES Market Intelligence, the premier platform for private market data and insights. Whether you're analyzing fund, direct, or operating company performance, CEPRES provides everything you need to support your stakeholders and make data-driven decisions.

Access insights from over 13,000 funds and 130,000 portfolio companies, enabling you to prove your investment thesis, develop portfolio strategies, and mitigate systematic risks with confidence.

CEPRES works directly with GPs to source the data you need to meet your portfolio goals. We verify every data point, down to individual operating cash flows, ensuring that 100% of your data is accurate, actionable and governed.

With more than 13,000 funds and 1,000,000 cash flows, CEPRES provides the most accurate, actionable private market data.

Leverage 50+ years of portfolio company cash flow performance as empirical evidence to make more informed investment decisions.

Comprehensive Analysis

Measure a GP's track record or benchmark your portfolio's performance against broader private and public markets. Move beyond traditional benchmarking by comparing your performance against real marketplace metrics, such as IRR, MOIC, alpha, TVPI, and operational KPIs like revenue CAGR and EBITDA growth. CEPRES empowers you to create, test, and refine your investment strategies, accelerating your impact in an increasingly complex private market landscape. Some types of analysis you can conduct with CEPRES Market Intelligence:

Market Intelligence Solutions

Benchmarking

Accurate, verified GP cash flow analysis at the fund and deal level for deeper insights into the true drivers of portfolio risk, return, and value

Market Research

Customized analysis to research and model private market investment strategies

Benchmarking

Accurate, verified GP cash flow analysis at the fund and deal level for deeper insights into the true drivers of portfolio risk, return, and value

Market Research

Customized analysis to research and model private market investment strategies

Featured Content

The PE industry has grown rapidly over the last two decades, recording an extraordinary increase in funds raised, fund size, deal volume, and overall deal size. But a perennial challenge – illiquidity – has remained largely unresolved, until now.

The Solactive CEPRES US Private Equity Industry Replicator Index is a new approach that provides return exposure to the return profile of buyout funds focused on North America.

This new replication approach, based on reweighting publicly listed equities, can deliver a similar performance to the North American private equity sector.

Insights

The Maturing Market: How Secondaries Are Redefining Liquidity, Pricing, and Portfolio Strategy in Private Equity

Learn how advanced secondary modeling can help you manage liquidity, pricing, and portfolio risk in today’s private equity market.

Navigating Private Markets in a Changing Landscape: Data Driven Insights to Optimize Returns and Manage Risk

Private equity has entered a new phase — returns are converging, risks are rising, and data-driven decision making now defines success.

Drawing on 20 years of CEPRES deal-level data from over 140,000 deals, this whitepaper reveals how top-quartile managers continue to outperform in today’s volatile market.

Learn how leading allocators are using data transparency to capture the next generation of returns.

Download the whitepaper

CEPRES' 2026 Private Equity Buyout Outlook

With fundraising still below pre-peak levels and market conditions evolving, LPs and GPs face mounting pressure to deliver returns. Download our latest report for data-driven insights into how top firms are refining strategies, structuring deals, and driving performance to stay competitive through 2026.

The Maturing Market: How Secondaries Are Redefining Liquidity, Pricing, and Portfolio Strategy in Private Equity

Learn how advanced secondary modeling can help you manage liquidity, pricing, and portfolio risk in today’s private equity market.

Navigating Private Markets in a Changing Landscape: Data Driven Insights to Optimize Returns and Manage Risk

Private equity has entered a new phase — returns are converging, risks are rising, and data-driven decision making now defines success.

Drawing on 20 years of CEPRES deal-level data from over 140,000 deals, this whitepaper reveals how top-quartile managers continue to outperform in today’s volatile market.

Learn how leading allocators are using data transparency to capture the next generation of returns.

Download the whitepaper

CEPRES' 2026 Private Equity Buyout Outlook

With fundraising still below pre-peak levels and market conditions evolving, LPs and GPs face mounting pressure to deliver returns. Download our latest report for data-driven insights into how top firms are refining strategies, structuring deals, and driving performance to stay competitive through 2026.