How high inflation affects private equity investment is a complicated question. But the industry has undergone previous periods in similar environments. To offer a case study into how historic deals have performed in these circumstances, we look at private equity deal returns during the previous historic period of high inflation: 1989-91.

The last time US inflation passed 6% was in September-December 1990

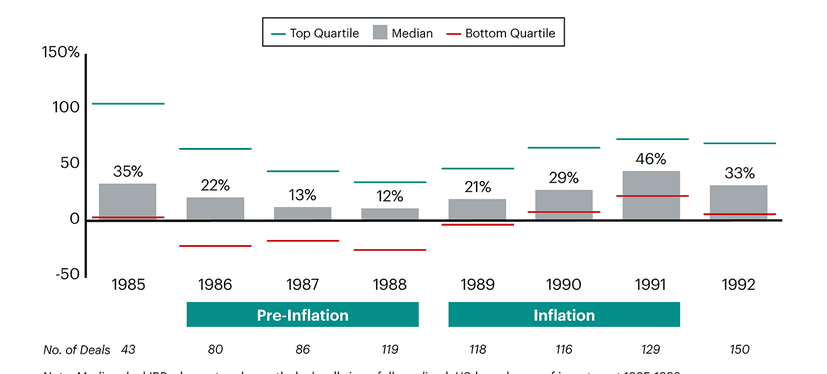

Using US Federal Reserve data, we identified the last time inflation reached 6%, in late 1990. We further identified two phases: a pre-inflation period in 1986-88, and a high-inflation period in 1989-91.

We then examined the returns of US private equity deals entered during these two phases, to see how high inflation affected performance in the industry.

Deals in the pre-inflation period have markedly lower returns than those entered in the high inflation period

Deals entered in 1986-88 had generally lower median IRRs than their counterparts entered in 1989-91. In fact, median returns in 1991 were more than twice as high as in 1986.

Deals entered in 1986-88 had generally lower median IRRs than their counterparts entered in 1989-91. In fact, median returns in 1991 were more than twice as high as in 1986.

Returns fell across most quartiles from 1986-88, before climbing successively to 1991. Bottom quartile returns did not exceed negative 15% at all in the pre-inflation period.

The difference between the top and bottom quartiles was mostly consistent throughout, ranging from 50 to 62 percentage points across 1987-1991. Deals made in 1986 saw a much wider spread of 87pp.