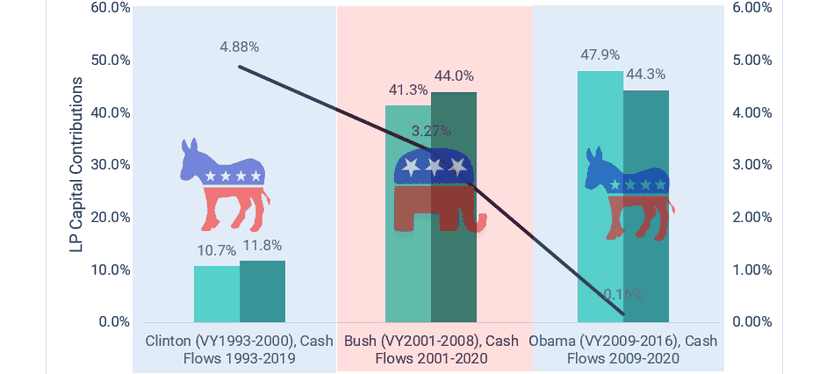

How the political color in the United States has helped shape the investment landscape

Part III: Blue Donkey: 2009-2016, Barack Obama

It’s January 2009 - the US economy and markets were in the midst of a meltdown due to the Global Financial Crisis. Despite the Federal Reserve’s efforts in 2008 to cut interest rates, bailout financial institutions, and pump liquidity into the financial system through bond purchases, and the federal governments various emergency programs to mitigate the market collapse, the GFC’s wrath continued. The Dow Jones continued its plummet from over 12,000 in January 2008 to its 6,600 trough in early March 2009. US GDP contracted by 8.4% in Q4-2008 and then a further 4.4% in Q1-2009. The turmoil had also spread from Wall Street to Main Street: millions of people were losing jobs as the unemployment rate eventually peaked at 10% in October 2009, and mortgage foreclosures and homelessness were on the rise. The new Democrat-led White House had a full plate on Day 1.

The American Recovery and Reinvestment Act of 2009, also commonly known as The Recovery Act, was a nearly $800bn stimulus packaged signed into law by President Obama in February 2009, just one month into his new job. The law was designed to save existing jobs, create new jobs, provide financial relief programs and invest public funds in infrastructure, education, healthcare and renewable energy. In March 2009, the US Treasury launched a program to acquire some $2 trillion worth of toxic assets from the balance sheets of financial institutions, while the federal government bailed out General Motors and Chrysler.

It was an all-out effort to rescue and turnaround the US economy from top to bottom. Besides for these fiscal measures, the Federal Reserve led by Chair Ben Bernanke also continued to do its part with monetary policy. By October 2008, the federal funds rate had dropped below 1%, and starting in 2009, rates were near zero for the seven years through 2015 with the aim to stabilize and stimulate the US economy.