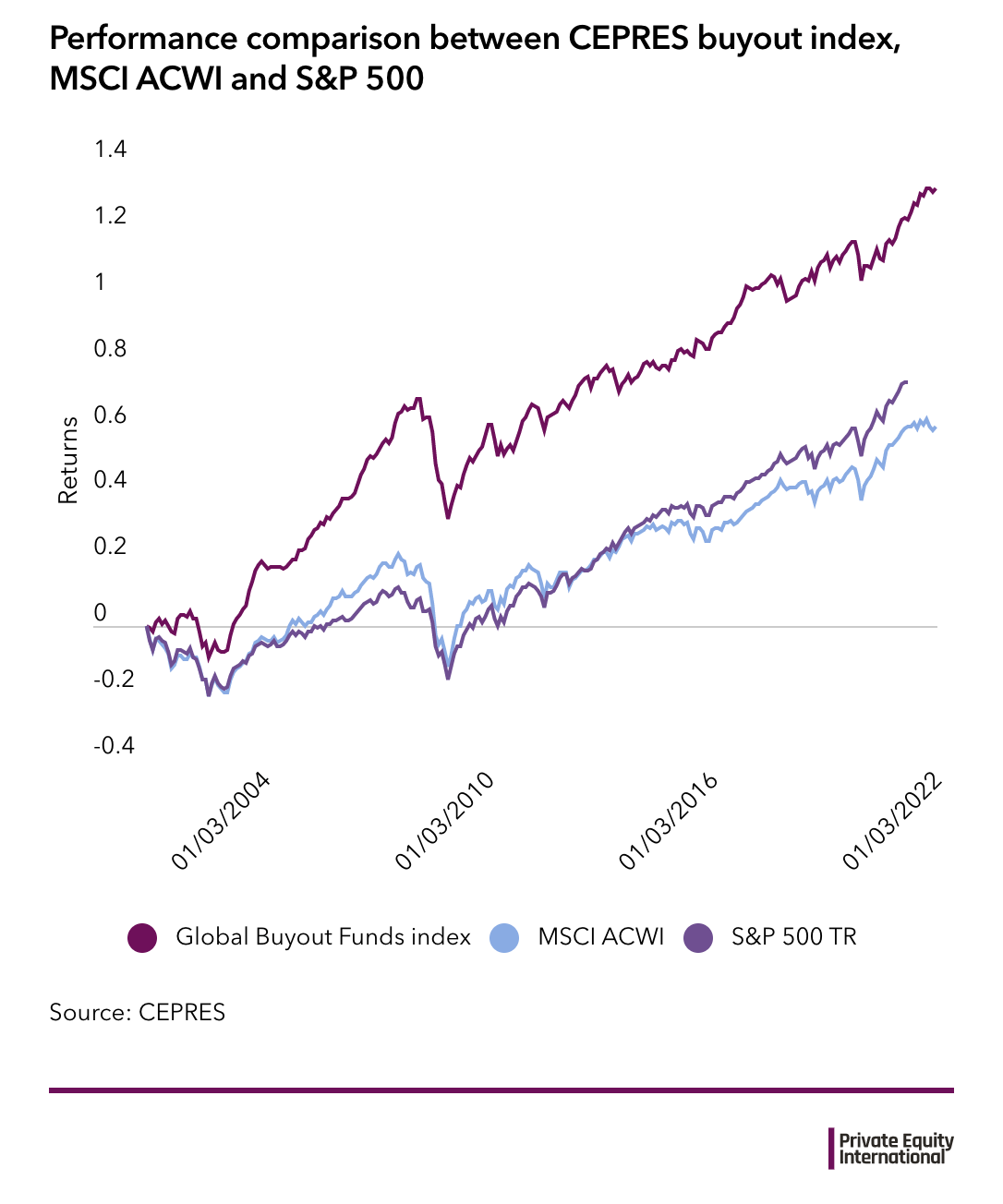

For its 21st Anniversary edition, Private Equity International asked CEPRES to run the numbers on PE’s performance over the last 21 years, and its findings should please our readers. According to analysis from the private markets data provider, the CEPRES global buyout funds index has outperformed the S&P 500 and the MSCI ACWI – which tracks a broad selection of large- and mid-cap stocks from 47 markets – every quarter in every year since 2001.

The returns produced by buyout funds have, however, been more volatile than their public market equivalents, per the CEPRES analysis, which is perhaps surprising given that many LPs often cite a perceived lack of volatility as a reason for investing in the asset class. One of the strongest periods for buyout funds over the past 21 years was 2003 to 2007, with the largest single-month increase, 11.08 percent, coming in April 2003.

CEPRES, which draws on a data set spanning around 11,000 funds and more than 107,000 PE-backed companies, also compared the performance of buyout funds with other alternative asset classes. It found that while buyouts consistently outperformed its index of real estate funds – apart from a brief period in 2004 – there was a solid stretch after the global financial crisis where private infrastructure outperformed buyouts. Infrastructure has produced the least volatile returns and clearly outperformed public equities benchmarks as well.

Continue reading on Private Equity International (opens in new window)